Smooth delivery throughout Brexit

Smooth delivery throughout Brexit

Latest News

Latest News

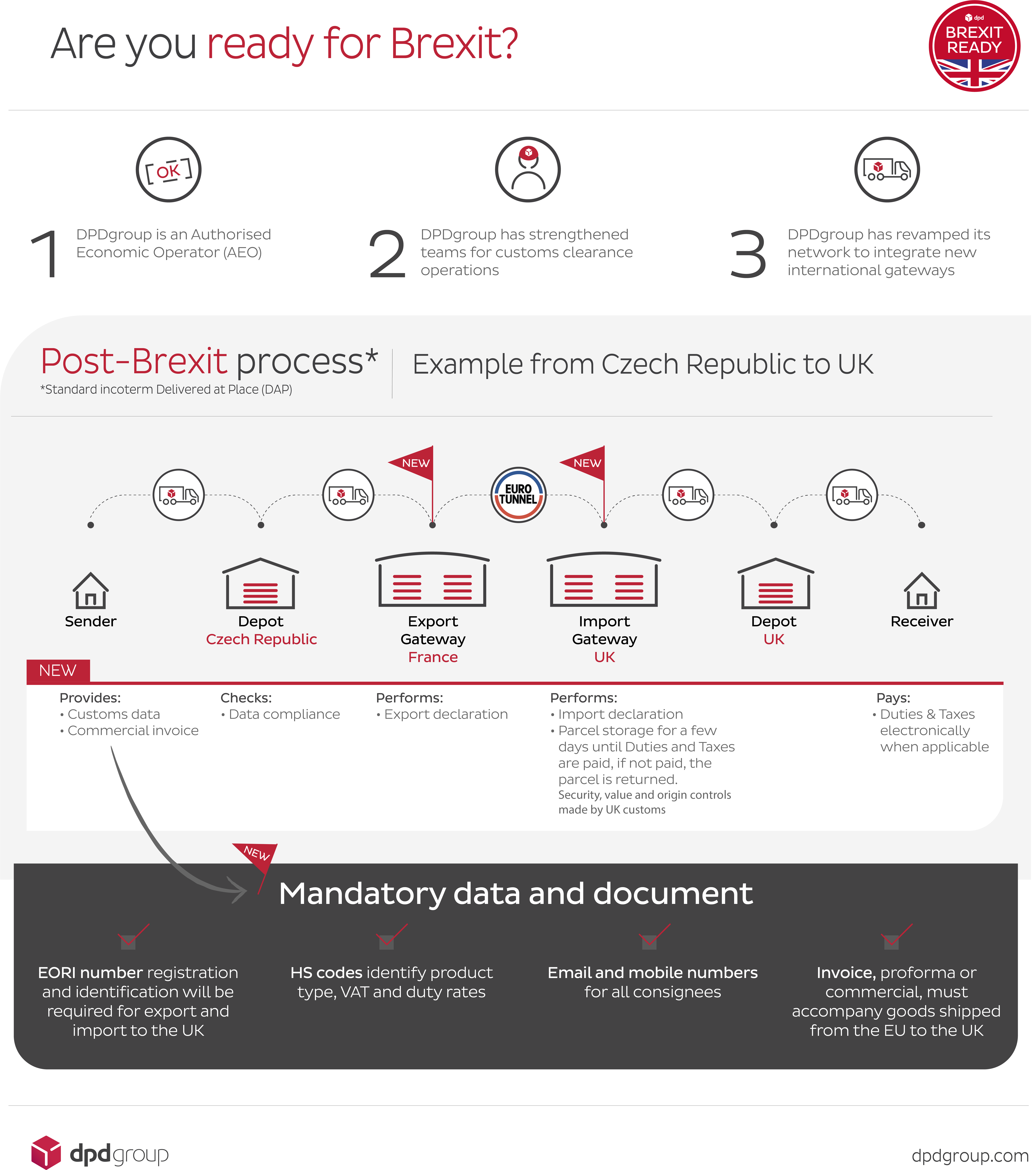

On 24 December 2020, the new EU-UK Trade and Cooperation Agreement was agreed in principle and has come into force on 1 January 2021.

From 1 January, the trade and movement of goods between the UK and the EU are subject to the new terms and rules outlined in the Agreement. It has been agreed that for many products no import duties have to be paid on both sides.

For our parcel industry, it means that between the UK and the EU:

-

Detailed data are required to export goods

-

Customs declarations are required for each parcel

-

The goods sent are subject to VAT (and duties when applicable)

-

Inspections may take place on some goods imported or exported

-

Rates change as a result of customs handling

-

Transit times may increase because of linehaul changes and potentially customs checks

Current specifics and conditions linked to Brexit:

-

Since 22 December, 2020 we cannot deliver parcels to Jersey, Guernsey and the Isle of Man (Channel Islands)

-

Customs conditions for Northern Ireland remain the same:

-

Northern Ireland will be considered as part of EU in terms of transport of goods (intra-Community trade). It means that for the transport to and from Northern Ireland there will be the same duties as e.g. for Intrastat.

-

-

Transit time for the UK will be extended for 2 workdays. Conditions for Ireland and Northern Ireland remain the same.

-

Newly, it will not be possible to deliver goods from natural person in C2C (Customer to Customer) and C2B (Customer to business) regime

-

Export customs clearance fee incl. transit will be 400 CZK per parcel.

https://www.dpd.com/wp-content/uploads/sites/226/2020/12/infographics-Brexit-final_CZvEN-1.png

https://www.dpd.com/wp-content/uploads/sites/226/2020/12/infographics-Brexit-final_CZvEN-1.png

4 necessary steps for businesses

EORI Number

EORI Number

EORI stands for Economic Operator Registration and Identification number. For any scenario, this number is mandatory for exporting and importing goods to/from the UK.

Apply for an EORI number if you do not already ship goods outside the EU. The registration for the EORI can be done via the website of local customs authorities. It can take up to 3 days to get this EORI number.

EORI Number = Country code + unique national number

Example of EORI number for a Polish exporter (country code PL) whose unique national number is 1234567890ABCDE → PL1234567890ABCDE

Commodities (HS code)

Commodities (HS code)

The HS codes are also known as Commodity Codes. These codes allow customs to identify the type of product, the VAT or duty rate that applies to the product to be exported. Goods cannot be exported or imported without these HS codes.

The HS codes can be found on this website: http://ec.europa.eu/taxation_customs

1 to 6 are worldwide identical (except some countries)

7 to 10 : details of the commodities

11 to 14 : additional code at import impacted the duty code

Data

Data

For shipments done either via API (Application Programming Interface), an integrated system or EDI (Electronic Data Interchange), there will be necessary IT updates to be done in preparation for Brexit to ensure that data such as descriptions, values or HS codes are included and on DPD format.

Potentially, if data is not complete and/or incorrect, parcels will not leave the sending country.

Commercial invoice

Commercial invoice

A commercial or pro forma invoice is needed when you ship goods outside the EU.

-

A commercial invoice is used when the goods are related to a commercial transaction or for resale

-

A pro forma invoice is used when sending goods without any commercial value (for example samples)

Both documents are a declaration including all information related to goods, that will be used by customs authorities in order to evaluate the duties or taxes to pay.

After Brexit

Exports to the UK - Goods below 135£

Standard European procedures apply to consignments sent to Northern Ireland.

For any specific question related to Brexit, please contact your local sales representative.

Homepage / Brexit