What exactly is changing on 1 July?

- The VAT exemption for goods worth up to EUR 22 being imported into the EU will be abolished. This means all goods will then be subject to VAT irrespective of their value.

- The Import One-Stop Shop (IOSS) is being made available to B2C suppliers from non-EU countries by all the EU member states in order to simplify the VAT settlement process. This will ease the process of declaring, collecting and paying VAT on distance sales (B2C) worth up to EUR 150.

Which goods deliveries does the IOSS system apply to?

- All goods shipped to the EU (imports into the EU) with an intrinsic value of up to EUR 150 (value not including taxes and shipping costs).

- Goods not subject to excise duties (typically alcohol and tobacco products).

How does the IOSS work?

- A supplier (in a non-EU member state) who is registered with the IOSS is obliged to invoice a private person in the EU with VAT in the case of a sale worth up to EUR 150.

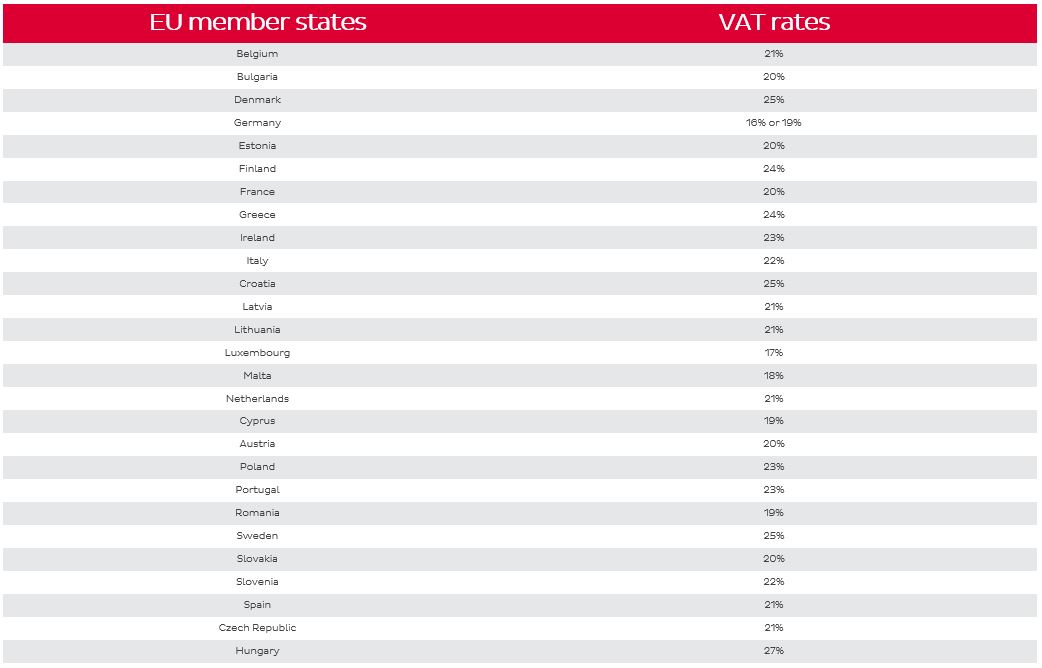

- The VAT rate applicable is that of the EU member state to which the goods are delivered (destination country).

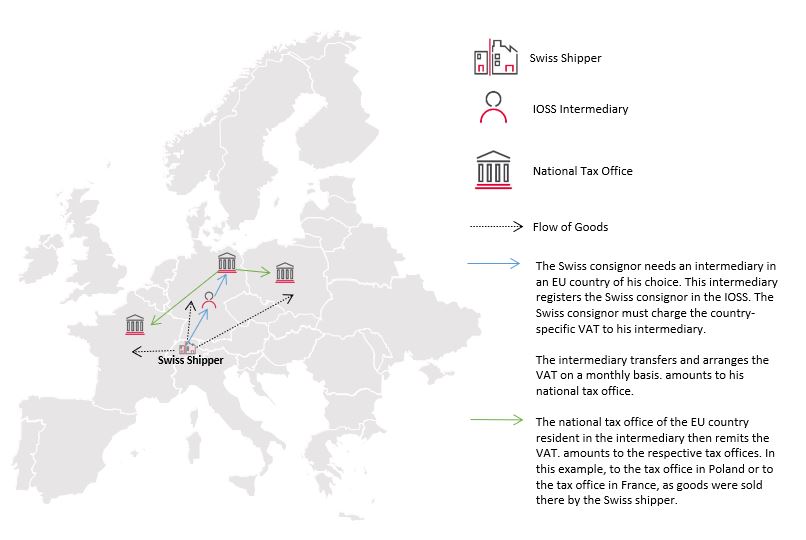

- As a Swiss sender, you need to register in the IOSS via an agent in an EU country (Member State of Identification).

- The IOSS number is distinct and valid throughout the EU and is recognised by all EU customs authorities.

How can you register for the IOSS?

- You can register via each EU member state’s IOSS portal. The time at which this new function will be implemented may vary from member state to member state.

- As a Swiss trader, you need to request an IOSS number from your tax representative (an agent based in your member state of identification).

- You need only register for the IOSS once and only in one member state; this registration will then be valid and recognised throughout the EU.

What changes now for you when you use the IOSS?

- Display the VAT rates applicable to each destination country on your website.

- Charge VAT to the buyer at the VAT rate applicable in their destination country.

- Only apply the IOSS rules when selling goods with a goods value of less than EUR 150 to European private persons.

- Quote the price actually paid by the buyer on the invoice, ideally in EUR.

- Submit an electronic monthly VAT return via the IOSS portal of the member state where you are registered for the IOSS.

- Pay the VAT collected from your buyers via the IOSS portal of the member state where you are registered.

- Keep records of all the sales you register via the IOSS for ten years.

- Provide DPD with the information required for customs clearance, specifically your EORI number and your IOSS number.

What changes are there for consignments sent via DPD?

- There is no longer VAT exemption for imports into the EU, including for consignments worth less than EUR 22.

- IOSS registration is mandatory for B2C consignments worth less than EUR 150 being sent to private persons in the EU.

- For all B2C consignments worth less than EUR 150, you must provide the sales invoice including VAT, quote your IOSS number and apply the VAT rate applicable to the destination country.

What remains the same for consignments sent via DPD?

- B2C consignments worth more than EUR 150 will continue to be subject to customs duties in the first EU member state into which they are imported (Germany, France, Austria and Italy).

- B2B consignments will continue to be processed either by means of EU customs clearance or the standard customs clearance in the first EU member state into which they are imported (Germany, France, Austria and Italy).

- Presentation of a detailed invoice (EORI number, VAT identification number, description, origin) remains mandatory for all non-IOSS consignments.

Where can I find out about the IOSS?

- On the website of the European Commission (fact sheets available): https://ec.europa.eu/taxation_customs/business/vat/new-oss-schemes_de

- If you decide to register for the IOSS, you must use the one-stop shop for the VAT of your chosen member state (can usually be found on the customs authority’s website).

- You can also find the FAQ on our website DPD Switzerland | Support for international delivery | Types of customs clearance