Deliveryt to United Kingdom

Changes

Changes

- Customs procedures have been applied for parcels to UK since 2021.

- An additional fee of EUR 5.40 is applied for all parcels up to 31,5 for every parcel for export customs clearance. The fee will be added to the existing delivery price.

- The Brexit changes do not apply to parcels to/from Northern Ireland.

-

Delivery time to UK - 7-8 working days.

We present information, which would help to prepare for convenient parcel deliveryt to UK. Here are a key steps that you need to take to ensure that you are ready for export to UK. Have You made agreement on DAP service of “Incoterms“ with Your customers jet?

3 steps to proper parcel preparation

Data

Mandatory information on the label and in the parcel data is following:

Sender data:

-

Name Surname / Company name;

-

Address (Street, house/property no, town);

-

Postal code;

-

Phone number or E-mail.

Receiver data:

-

Name Surname / Company name;

-

Address (Street, house/property no, town);

-

Postal code;

-

Phone number (phone number should be UK, information via SMS is not sent in foreign phone number).

-

Email address is optional but if consignee email is specified, it must be correct. Please do not use "Ebay" email addresses (e. g. [email protected]).

IMPORTANT! The recipient's contact details on the shipment label must match the contacts provided in the accompanying documents.

Documents

Invoice should be in ENGLISH.

Mandatory data filled:

-

Correct description of goods;

-

No HS code is required if description of goods is detailed;

-

Phone number;

-

Sender EORI number;

-

Sender VAT number in case of B2 shipment;

-

HMRC (SPRN) number of sender in case of B2C shipment <135£;

-

Value of goods;

-

Parcel number.

Packing

-

Goods inside the package must be packed safely.

-

Label must be sticked on widest side.

-

Documents for customs must be sticked in sticky pocket on top of the package - it shouldn‘t be inside the box.

-

No restricted goods are allowed to UK:

-

alcohol beverages,

-

tobacco,

-

food products,

-

drugs/medicines;

-

Consignments not exceeding the standard size and weight dimensions are delivered to the United Kingdom. Parcels that are not the standard dimensions are not delivered to the UK.

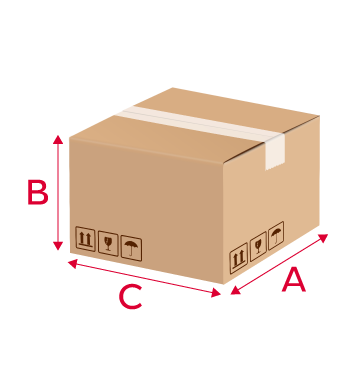

The standard package is packaging that meets all requirements for dimensions and weight. Below are the minimum and maximum allowable dimensions of the standard package.

* Package volume – the sum of the shortest perimeter and longest edge of the package. The volume of the package is calculated like this: (height + width) × 2 + length, i.e. (A + B) × 2 + C.

A Maximum width, cm | B Maximum height, cm | C Maximum length, cm | Volume of package* | Maximum weight, kg | |

Min | Min | Min | Max | Max | Max |

12 | - | 16 | 175 | 300 | 31,5 |

Min

12

B Maximum height, cm | Min | - |

C Maximum length, cm | Min | 16 |

Max | 175 | |

Volume of package* | Max | 300 |

Maximum weight, kg | Max | 31,5 |

EORI number

EORI number

If you haven't done so already, apply for an EORI number if you do not currently ship goods outside the EU.

What is EORI number?

EORI stands for Economic Operators Registration and Identification number. Remember that if you attempt to import from, or export to, any country outside the EU without this number, your goods will be held.

How could I get an EORI code?

EORI number is provided by Customs of the Republick of Lithuania. It can take up to 3 days for this EORI number to be live.

Contacts for EORI:

Vilnius TM +370 5 235 6223, +370 5 235 6226;

Kaunas TM +370 37 304 277, +370 37 304 271;

Klaipėda TM +370 46 390 082, +370 46 390 109;

Customs Department +370 5 236 2312, +370 5 236 2387.

If you haven't done so already, apply for an EORI number if you do not currently ship goods outside the EU.

What is EORI number?

EORI stands for Economic Operators Registration and Identification number. Remember that if you attempt to import from, or export to, any country outside the EU without this number, your goods will be held.

How could I get an EORI code?

EORI number is provided by Customs of the Republick of Lithuania. It can take up to 3 days for this EORI number to be live.

Contacts for EORI:

Vilnius TM +370 5 235 6223, +370 5 235 6226;

Kaunas TM +370 37 304 277, +370 37 304 271;

Klaipėda TM +370 46 390 082, +370 46 390 109;

Customs Department +370 5 236 2312, +370 5 236 2387.

Harmonisation codes

Harmonisation codes

Start looking up HS (Harmonisation) codes for the products that you wish to export from the EU.

These HS codes are also known as Commodity Codes. These codes let Customs know what your product is, and what VAT or Duty rate to charge for the goods. If you have a number of different products to sell, you should start compiling these codes now. Information about HS codes here.

Contacts of consignee

Contacts of consignee

Ensure that you are capturing email and mobile numbers for all of your consignees.

Contacts will be critical to each shipment travelling between Lithuania and UK and UK and Lithuania. The contact details will be used to communicate with your customers to make them aware of any taxes and duties payable. If we don’t receive these details in the consignment information, we will not be able to process the shipment.

Phone number should be UK, information via SMS is not sent in foreign phone number.

Ensure that you are capturing email and mobile numbers for all of your consignees.

Contacts will be critical to each shipment travelling between Lithuania and UK and UK and Lithuania. The contact details will be used to communicate with your customers to make them aware of any taxes and duties payable. If we don’t receive these details in the consignment information, we will not be able to process the shipment.

Phone number should be UK, information via SMS is not sent in foreign phone number.

SPRN number

SPRN number

If you're exporting from Lithuania to Great Britain, you'll need an SPRN Number.

What is an SPRN Number?

SPRN means Small Parcel Registration Number. SPRN is applicable for parcels, which value not exceed 135 £. It relates to exports from Lithuania to North Ireland and Great Britain.

Why do I need an SPRN Number?

If you provide us with your SPRN Number in your shipping data, your consignee will not be billed for any UK VAT. Rather, HM Customs will bill you directly. Billing will not commence until October 2019 - billing raised in October will retrospectively cover all shipments dispatched from October 31st onwards (in the event of a Hard Brexit).

How can I get my SPRN Number?

An SPRN Number is a mandatory requirement for all shipments travelling to North Ireland and Great Britain from Lithuania. You can get SPRN number here.

IMPORTANT!

The terms of "Incoterms“ are provided by DPD for all parcels to United Kingdom. The terms will be DAP. What do You have to do?

-

Apply for EORI number (provided by Customs of the Republick of Lithuania)

-

If You send goods whose value is less than 135 £, You need register to Customs of UK and get HMRC/SPRN number.

-

Specify exact parcel weight.

-

Following infrmation are mandatory on invoices:

-

Detailed description of the each goods.

-

Receiver mobile number.

-

Sender email.

-

Sender EORI number.

-

Receiver EORI number (if receiver is company).

-

Sender VAT number.

-

Sender SPRN number for parcels whose value is less than 135 £.

-

Value of goods

For further information please contact Sales Department by phone +370 5 219 2727 or by email [email protected].

Information of Brexit to download

Home / Send parcels / International delivery / Delivery to UK