Export and customs information

Problem-free customs clearance with DPD.

Export and customs information

Problem-free customs clearance with DPD.

If you are exporting goods to a country outside the European Union, customs clearance is mandatory. We handle export customs clearance for businesses only.

Get all the information you need on this here, and download the documents that must be completed for customs clearance.

Documents for road-transport customs clearance:

Documents for air-transport customs clearance:

Where can I find out about customs tariffs?

Where can I find out about customs tariffs?

The EU's customs tariff database TARIC integrates all EU tariff, commercial and agricultural legislation. It facilitates the uniform application of these provisions by all EU countries and gives all economic operators a clear view of measures to be taken when importing or exporting goods into or out of the EU.

Access the TARIC database at: http://kkk.nav.gov.hu/eles/1/taricweb/

Identifiability for customs procedures

Identifiability for customs procedures

The VPID number is what identifies the business during Hungarian customs procedures. It automatically gives the international Economic Operators’ Registration and Identification (EORI) number.

The 12-character VPID is the primary identifier for the customs authority. Under EU rules, every person or business has been obliged to request such an identifier for all customs and excise procedures since 1 May 2004. No customs clearance can be carried out for anyone or any company that does not have a VPID number.

The EORI number is valid in all EU member states for economic operators and persons established or resident in EU member states. It is a unique identifier issued by the customs authority of the operator's own state and serves to identify the client during customs procedures.

Why do you need a commercial invoice?

Why do you need a commercial invoice?

Shipping of goods or documents outside the EU must be declared.

This involves enclosing a commercial invoice or proforma invoice with the goods.

- A commercial invoice is required if the goods have commercial value.

- A proforma invoice is required if the goods do not have commercial value.

In either case, the documents must give the details of the sender and the receiver, a list of the contents of the consignment, and its value. The sender signs these and encloses one original and three copies with the goods. Press the commercial invoice button to produce the invoice and print it out on company notepaper.

Clear and uniform: terms of delivery

Clear and uniform: terms of delivery

The terms of delivery stated in the contract of delivery define the carriage costs borne by the sender and the recipient. These terms of delivery are based on Incoterms, the internationally-recognized rules for assigning to sender and recipient.

It is important for both sides to know which Incoterm their contract is based on. The term DDU has been replaced by DAP. The place of destination must be given as precisely as possible during the procedure. It is not sufficient, for example, to state "DAP Oslo", because the consignment cannot be cleared for customs without stating the place.

DPD uses DAP terms. This involves the sender paying the costs of carriage and export customs clearance, and the recipient pays import customs clearance, customs duties and VAT. The countries affected are Switzerland, Norway, Bosnia-Herzegovina and Serbia.

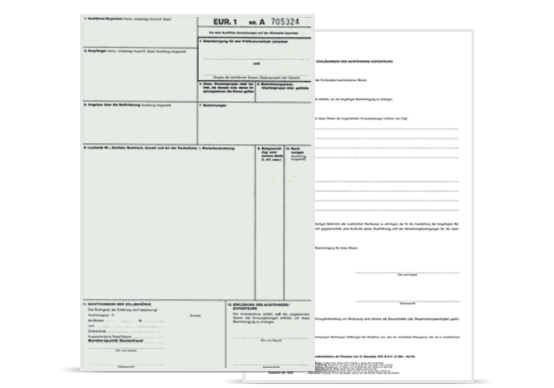

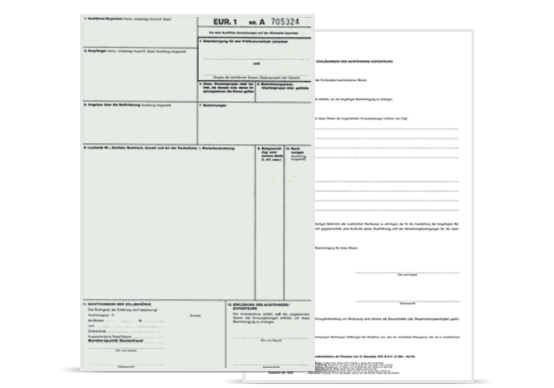

Help to completing the movement certificate

Help to completing the movement certificate

The EUR 1 movement certificate is the preference document for goods made in the EU. Entitlement to preference may be important for calculating the import duties payable on the goods by the recipient. The sender completes the certificate forms and submits them to the customs authority for export. The forms may be obtained from the chamber of commerce.

The EUR 1. certificate is necessary for consignments within the European Economic Area (EEA) and in Egypt, Algeria, Israel, Jordan, the former territory of Yugoslavia (Bosnia-Herzegovina, Serbia, Montenegro, Kosovo, Croatia and Macedonia), Lebanon, Morocco, Palestine, Syria, Tunisia, Norway, Iceland, Liechtenstein, Switzerland, South Africa, Chile, Mexico, Albania, Andorra, Africa, the Caribbean islands and the Pacific.

Customs authorities can change.

Export border crossing points and their codes

Country/Service | Customs office | Official number | Route |

Norway | Flensburg | DE006133 | DE |

Switzerland | Bietingen | DE004101 | DE |

Bosnia-Herzegovina | CI Slavonski Brod | HR070548 | HR |

Serbia | CI Tovarnik | HR070327 | HR |

Norway

Switzerland

Norway

Bosnia-Herzegovina

Norway

Serbia

Customs office | Flensburg | Bietingen | CI Slavonski Brod | CI Tovarnik |

Official number | DE006133 | DE004101 | HR070548 | HR070327 |

Route | DE | DE | HR | HR |

Place of import customs clearance

Country | Customs office | Route |

Bosnia-Herzegovina | Szarajevó | BA |

Norway | Oslo | NO |

Switzerland | Wittenwil | CH |

Serbia | Belgrád | RS |

Bosnia-Herzegovina

Norway

Bosnia-Herzegovina

Switzerland

Bosnia-Herzegovina

Serbia

Customs office | Szarajevó | Oslo | Wittenwil | Belgrád |

Route | BA | NO | CH | RS |