Export and customs information.

Trouble-free customs clearance.

Export and customs information.

Trouble-free customs clearance.

Export certificate and confirmation of arrival

Companies which are located in Germany have to prove that shipments of goods to companies in other EU countries or non-EU countries have actually been delivered. This proof can be legally provided in the form of:

-

the confirmation of arrival (EU),

-

the export certificate (non-EU countries),

-

a CMR consignment note,

-

a carrier's receipt

-

other standard commercial document containing the confirmation of the consignee that the goods have been received.

For more information on exporting see the following documents:

This is why you need a commercial invoice

This is why you need a commercial invoice

In accordance with the applicable customs regulations, the shipment of goods or documents outside of the EU is subject to declaration. This means that the goods have to be accompanied by a commercial invoice or a pro forma invoice.

- A commercial invoice is drawn up if the goods have commercial value.

- A pro forma invoice is drawn up if the goods have no commercial value.

Whether it's a commercial invoice or a pro forma invoice, the document indicates the consignor and consignee, contains a full description of the contents of the shipment and details of their value. It is then signed by the consignor, who sends the original and three copies with the parcel.

This enables you to create your commercial invoice or pro forma invoice and print it out on your company stationery.

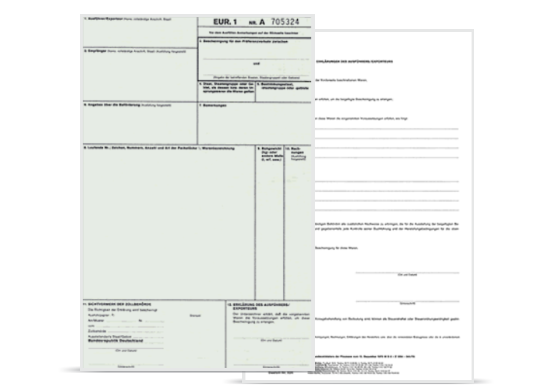

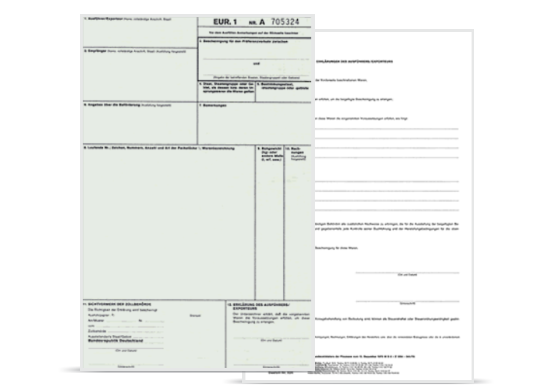

All the necessary information about the movement certificate.

All the necessary information about the movement certificate.

The EUR 1 or EUR-MED movement certificate is a preferential document for goods produced within the EU. This preference can be important in terms of calculating the import duties which the consignee has to pay.

The movement certificates are drawn up by the consignor on the relevant standard forms and submitted to the customs authorities when the goods are exported.

The forms can be obtained from your Chamber of Commerce.

The EUR 1 or EUR-MED certificate applies to the movement of goods within the European Economic Area and to the following countries: Egypt, Albania, Algeria, Andorra, Bosnia and Herzegovina, Chile, Iceland, Israel, Jordan, Kosovo, Croatia, Lebanon, Lichtenstein, Morocco, Macedonia, Mexico, Montenegro, Norway, Palestine, Switzerland, Serbia, South Africa, Syria, Tunisia, states of the African, Caribbean and Pacific region, Overseas Countries and Territories.

All the information at a glance. All details are provided without guarantee. Changes made by the customs authorities are possible.

European road transport network of DPD

Country/service | Customs office | Official number | Route |

Norway | Berg i Østfold, Norge | SE060340 | DK/SE |

Island | Malmö Tullverket Staneregionen | SE000050 | DK/SE |

Switzerland / Lichtenstein - DPD CLASSIC - DPD EXPRESS | Bad Säckingen St. Louis Autoroute | DE004209 FR004050 | CH FR |

Channel Islands | Portsmouth | GB000292 | GB |

Bosnia and Herzegovina | CI Slavonski Brod | HR070548 | SI/HR |

| Bosnia and Herzegovina | CI Stara Gradiska1 | HR070521 | SI/HR |

Serbia | CI Tovarnik | HR070327 | SI/HR |

CI Bajakovo | HR070319 | SI/HR | |

Croatia (import to the EU of non-EU goods by means of a T1 consignment note) | CI Jankomir | HR030171 | SI/HR |

UK | Calais Port Tunnel | FR20001 | GB |

Country/service

Norway

Country/service

Island

Country/service

Switzerland / Lichtenstein

- DPD CLASSIC

- DPD EXPRESS

Country/service

Channel Islands

Country/service

Bosnia and Herzegovina

Country/service

Country/service

Serbia

Country/service

Country/service

Croatia (import to the EU of non-EU goods by means of a T1 consignment note)

Country/service

UK

Customs office | Berg i Østfold, Norge | Malmö Tullverket Staneregionen | Bad Säckingen St. Louis Autoroute | Portsmouth | CI Slavonski Brod | CI Stara Gradiska1 | CI Tovarnik | CI Bajakovo | CI Jankomir | Calais Port Tunnel | |

Official number | SE060340 | SE000050 | DE004209 FR004050 | GB000292 | HR070548 | HR070521 | HR070327 | HR070319 | HR030171 | FR20001 | |

Route | DK/SE | DK/SE | CH FR | GB | SI/HR | SI/HR | SI/HR | SI/HR | SI/HR | GB |

1 for shipments that require a Phytosanitary, Sanitary or Veterinary inspection

International air transport with DPD

Service | Customs office | Official number | Route |

DPD EXPRESS | Leipzig (airport) | DE005604 | DE |

Service

DPD EXPRESS

Customs office | Leipzig (airport) | |

Official number | DE005604 | |

Route | DE |

Custom clearance location by road transportation in Europe

Country | Customs office | Route |

Bosnia and Herzegovina | Sarajevo | BA |

Iceland | Reykjavik | IS |

Norway | Oslo | NO |

Switzerland / Lichtenstein - DPD CLASSIC - DPD EXPRESS | Wittenwil Hésingue | CH, FR |

Serbia | Belgrade | RS |

Country

Bosnia and Herzegovina

Country

Iceland

Country

Norway

Country

Switzerland / Lichtenstein

- DPD CLASSIC

- DPD EXPRESS

Country

Serbia

Customs office | Sarajevo | Reykjavik | Oslo | Wittenwil Hésingue | Belgrade | |

Route | BA | IS | NO | CH, FR | RS |

Uniform and clear: our terms of delivery

In a transport contract, the terms of delivery define the shipping costs which are the responsibility of the consignor and those which are the responsibility of the consignee. To make the process as simple as possible for you, our terms of delivery are based on the International Commercial Terms which are used worldwide.

- International Commercial Terms (Incoterms for short) enable the standardised processing of commercial transactions.

- They clearly regulate the distribution of costs and risks as well as the duty of care between buyer and seller. It is important for all those involved that the contract should specify which version of the Incoterms applies.

- The terms of delivery in the DPD system are based on Incoterms® 2020.

- The most important new feature: DDU terms have been replaced by DAP (delivered at place).

- In all delivery terms the place of destination should be defined as precisely as possible (e.g. DAP Oslo), because without indication of the place no customs clearance is possible.

If a different place of customs clearance is required to the one normally used in the DPD system, this will lead to additional costs. Please consult us in such cases. The cost will be invoiced to the principal, in other words the consignor or the consignee.

Foreign trade, import/export: links to selected Chamber of Commerce locations:

You will find Chambers of Commerce arranged by foreign trade focal points at info-weltweit.de

Foreign trade portals

All details are provided without guarantee. We accept no liability for the content of linked external websites.

Important explanations and frequently asked questions on international shipping

-

Export- und Zollinformationen

Customs declaration

In Germany the customs declaration is a tax declaration within the meaning of the fiscal code and customs regulations. The customs declaration for the export of goods to countries outside of the EU no longer uses paper forms, which have been replaced by the electronic declaration in the NCTS custom system (ATLAS shipping).

-

The export procedure can either be implemented online using the Internet export declaration (IAA-Plus) or by participation in the IT procedure ATLAS export/AES as well as verbally (goods valued below €1000).

- The submission of the customs declaration to the responsible customs office is regarded as an application for the implementation of customs processing.

- An export declaration must be submitted for every export of goods with an invoice value of over €1000 to a country outside of the EU.

What are dutiable goods?

-

Shipments of goods are always subject to customs duty if they are exported to, or come from, a country which is not part of the EU.

-

On the other hand, any parcels you send within the EU are not subject to customs duties or declarations

Export of dutiable goods

Goods which are exported to a non-EU country have to be accompanied by customs documents. These are in particular based on the regulations of the country of destination, the goods value and the contents of the shipment.

This regulation also applies to EU exclusion zones, which are:

-

Denmark: Faroe Islands, Greenland

-

Germany: Büsingen, Helgoland

-

Finland: Aaland Islands

-

France: overseas départements

-

Greece: Mount Athos

-

Italy: Campione d’Italia, Livigno, parts of Lake Lugano

-

Netherlands: overseas territories

-

Spain: Ceuta, Melilla, Canary Islands

-

Great Britain: Overseas Territories, Gibraltar, Channel Islands

-

Cyprus: Turkish area is geographically part of Europe, but not part of EU customs territory and customs legislation

Customs declaration and accompanying export documents

-

During the export process, goods with a value of over €1000 which are exported from the EU to a non-EU country are declared electronically to the customs authorities using the ATLAS export procedure or using IAA-Plus (Internet export declaration+, confirmation by means of an ELSTER certificate). This is also required if the goods value on an individual shipping day to various consignees in the relevant country of destination exceeds €1000.

-

After declaring your shipment you receive the accompanying export document from the customs authorities, together with the customs identification (MRN) number which is required for clearance. This also serves as proof of export.

-

If special customs regulations or sanctions apply in the case of the particular country, even shipments with a goods value of below €1000 have to be declared. In such cases the required permits and any other relevant documents have to be available during customs clearance. More information is available from the Customs or your Chamber of Commerce search.

-

The export declaration should be implemented at the latest 24 hours before the shipment is handed to the DPD dispatch depot.

-

As was previously the case, small shipments with a value below €1000 which are not subject to prohibitions and restrictions do not need to be declared electronically.

The export process and customs offices.

-

Because parcels are not necessarily processed at customs offices with the status of an office of exit, we recommend that shipments should be exported via the two-stage normal procedure (customs office at the company location). After that the shipment with all further export documents and the accompanying export document is handed to DPD.

-

The EU’s TARIC information system provides you with details of goods numbers, value limits and descriptions of goods.

Trade within the EU

-

The EU internal market has significantly facilitated trade within the 28 member countries, and this has also been helped by the introduction of the VAT identification number within the EU. At the same time new regulations have been introduced for trade with non-EU countries. Accordingly internal EU commerce is differentiated from worldwide export trade.

-

There are no customs duties on goods movements between EU countries. Customs formalities have also been lifted, which means that no customs documents are required any longer for the shipment of goods from one member state to another, unless the goods are subject to consumer taxes (e.g. alcohol, tobacco, oil) or are politically sensitive and subject to export controls.

-

The relevant permits are obtained from the Federal Office for the Economy and Export Control (BAFA).

-

The INTRASTAT declaration for goods movements within the EU is mandatory for companies which are subject to VAT and which ship or receive an annual volume of goods in excess of €500,000. This enables the Federal Statistical Office to record the movement of EU goods between member countries. It is not to be confused with the summary statement with which each company has to declare its internal EU sales to the Federal Central Tax Office.

EORI number

-

The EORI number (Economic Operators\' Registration and Identification) is the successor of the customs number at the European level. It serves to identify economic operators and to simplify automated customs processing.

-

EORI numbers are allocated by the customs authority and are required for customs processing within the European Union.

-

The EORI number can contain up to 17 digits. It begins with the two-digit country ISO code of the relevant member state. You can check on the central EU database if an EORI Number. has already been generated for your company.

-

Indicating their EORI number is mandatory for economic operators. Private individuals are not obliged to enter an EORI number in customs declarations. If the goods to be exported require a permit, however, then even private persons have to enter an EORI number.

-

In cross-border parcel shipping the EORI number is mandatory for customs processing.

Where can I get a confirmation of arrival?

The "confirmation of arrival" is proof that a shipment has been transported within the EU. At DPD the proof of delivery (POD) for a shipment is provided together with the DPD invoice for the shipment. Information on the confirmation of arrival (EU shipments) and on proof of export (export to non-EU countries) can be found on the Internet, e.g. on the website of the Federal Ministry of Finance (Bundesfinanzministerium).

Home / Support / International / Export and customs information